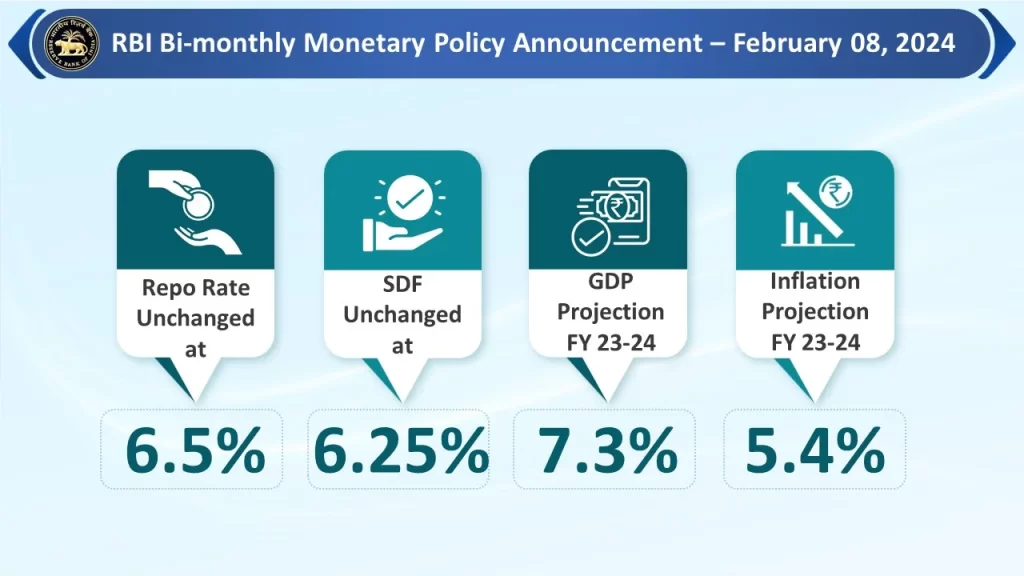

RBI Announces Monetary Policy Repo Rate unchanged at 6.5 percent, so if you’ve taken a loan for your home, car, or anything else, you’ll have to wait longer for any decrease in your monthly installments. The RBI has kept the repo rate unchanged at the current level of 6.5 percent for the sixth consecutive time.

Out of the six MPC members… Dr. Shashank Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra, and Shaktikanta Das voted in favor of maintaining the policy repo rate, while Prof. Jayant R Varma suggested a 0.25 percent reduction. The MPC members also decided to continue with their accommodative stance to bring retail inflation back to the target level.

What RBI Governor said about GDP Growth:

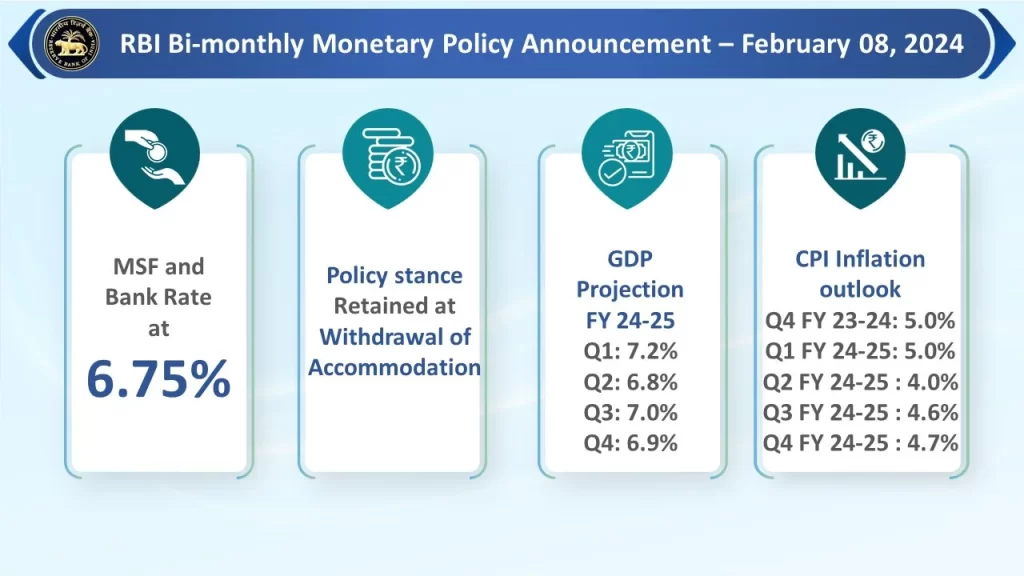

Das noted stronger economic growth driven by robust investments and sectoral improvements. He expects support from agricultural growth, stable manufacturing, and resilient services in 2024-25. Predictions indicate a 7% GDP growth for 2024-25, with steady growth across quarters. Domestic economic activity remains robust, with the current fiscal year expecting 7.3% growth, suggesting continued momentum into the next year.

Related News: Trent Share jumps 20 percent following Q3 results

What was said about inflation by RBI Governor:

Das talked about inflation, which depends on food prices globally. Rabi sowing has risen, but vegetable prices are uneven. Weather uncertainty adds to price unpredictability. Measures are needed to stabilize food prices. Consumer inflation is expected at 5.4% in 2023-24, 5% in Q4. With a normal monsoon, retail inflation could be 4.5% in 2024-25.

RBI Announces Monetary Policy Repo Rate unchanged at 6.5 percent

Approval for ‘hedging’ regarding gold prices:

The RBI announced new policies: reviewing electronic trading rules and allowing hedging in the OTC segment. They also approved offline digital currency use for banks and NBFCs, providing loan details to borrowers. This helps borrowers make informed decisions. The next MPC meeting is scheduled for April 3 to 5, 2024.

Regarding the Paytm issue:

RBI Governor Shaktikanta Das stated that the central bank has been in communication with Paytm for a while now, and all regulatory measures are aimed at ensuring systemic stability and protecting the interests of customers.